No more broken promises — I’ll protect Social Security and strengthen it

Social Security is more than a government program or an entitlement: It’s a benefit all Americans earn over their lifetimes to invest in their futures. But when Republicans have to pay off their tax breaks for millionaires, Social Security is always one of the first things on their chopping block — and President Trump has proven he won’t stand up for Social Security either.

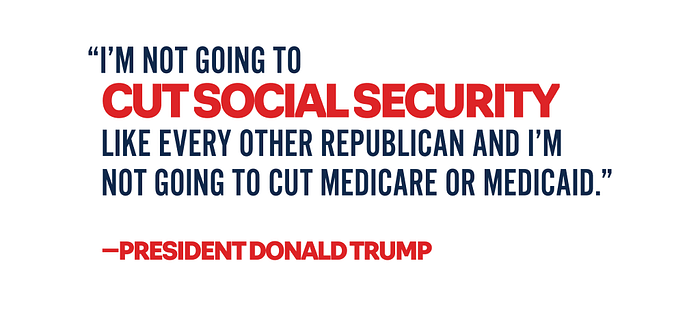

President Trump’s broken promise

When President Trump campaigned for president in 2015, he promised families he was different. “I’m not going to cut Social Security like every other Republican and I’m not going to cut Medicare or Medicaid,” he said. Lo and behold, in his first term, he’s threatened to cut over $25 billion from Social Security.

Over the last decade, I’ve fought to protect and expand hard-earned benefits for working families while President Trump has stiffed workers in his businesses more times than I can count. That’s not leadership — that’s theft.

I’m here to tell you that unlike President Trump, I’m a woman of my word. I will protect and expand Social Security, and I have a plan to do it.

How I’ll fix it

My Social Security Expansion plan will protect and enhance Social Security, do right by our seniors, and ensure future generations can access this important benefit. Here’s how:

I’ll strengthen Social Security and increase benefits.

It’s critical that we increase Social Security benefits, because while essential to keeping millions out of poverty, they’re not enough. That’s why I’ll increase overall Social Security benefits by approximately $65/month and raise the floor for minimum benefits. We’ll also allow all full-time students with deceased or disabled parents to receive benefits through Social Security, closing the gap in eligibility for people between 18 and 22 years old. Lastly, we’ll ensure that surviving spouses receive full benefits and eliminate the cap on total benefits.

I’ll extend the solvency of Social Security to ensure its longevity, and make sure the ultra-wealthy pay their fair share.

I will Increase the Social Security payroll tax cap on earnings to apply to those earning more than $250,000, ensuring that the ultra-wealthy pay the same rate as working class Americans. I’ll also enact an additional 3.8% investment income tax and direct the generated revenue to the Social Security trust fund.

I’ll ensure seniors receive accurate cost of living adjustments.

We have to implement a smarter way to calculate cost of living increases for seniors so that their benefits can support them the way they’re supposed to. That’s why I’ll institute a consumer price index, CPI-E, that ensures seniors receive cost of living adjustments that reflect what they actually spend their money on.

I’ll safeguard public sector workers’ benefits.

Currently, Social Security benefits are limited when someone has a state pension plan, but with those plans floundering, full Social Security benefits are more important. To ensure public sector workers’ full benefits are protected, we’ll get rid of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), which harm public sector workers by reducing their benefits.

There is dignity in work. There is no dignity in denying working families benefits like Social Security when they’ve spent a lifetime earning them. It’s time for our government to honor the promises we’ve made, treat workers with the respect they deserve, and ensure families can build strong futures.